arizona estate tax exemption 2021

Even though there is no Arizona estate tax the federal estate tax may apply to your estate. The following retail sales are no longer taxable from and after june 30 2021.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Arizonas average state and local sales tax rate is 84.

. E Standard deduction andor personal exemption is adjusted annually for inflation. With the right legal steps a couple can protect up to 2412 million when both spouses have died. Married Filing Separate - 12550.

The minimum combined 2022 sales tax rate for Phoenix Arizona is. The current federal estate tax is currently around 40. 25100 for married couples.

The State of Arizona adopted several significant tax measures during the 2021 legislative session including an individual income flat tax a high-earner tax bypass and a federal SALT cap workaround. Arizona also allows exemptions for the following. Even though Arizona does not have its own estate tax the federal government still imposes its own tax.

But that doesnt leave you exempt from a number of other necessary tax filings like the following. For the 2021 tax year the standard deduction for state income taxes in Arizona is 12550 single or married filing separately 25100. This exemption rate is subject to change due to inflation.

The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent. Arizona offers a standard and itemized deduction for taxpayers. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

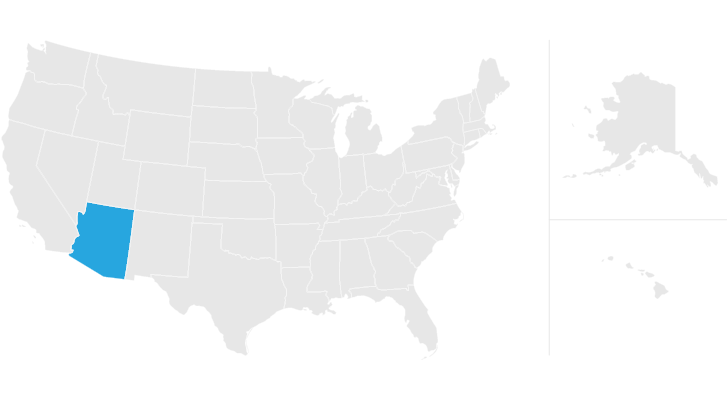

There are no inheritance taxes or estate taxes in Arizona. The Arizona sales tax rate is currently. The State of Arizona passed a bill on July 10 2021 that formalizes the sourcing rules and exemptions for transaction privilege tax for Indian tribes tribally owned businesses and affiliated Indians.

Head of Household -. Unfortunately this usually means that your property taxes also go up. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax.

Residents and nonresidents owning property there can rejoice. Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption. Arizona Formally Codifies Exemptions for Indian Tribes.

This rate reduction is the result of a 2019 tax reform law that also The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. This is the total of state county and city sales tax rates. This means that benefits annuities and pensions as retired or retainer pay of the uniformed services are no longer taxable in Arizona.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. The County sales tax rate is.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. The Federal Investment Tax Credit ITC is available to Arizona homeowners who purchase their solar panel system outright. Married Filing Joint - 25100.

This is not the case in the state of Arizona. This tax is portable for married couples. One of the benefits of going solar is the added property value to your hone.

The amount of tax-exempt interest income in Box 12 of 2021 IRS Form 1099-DIV should be multiplied by the applicable state percentage below to obtain the amount of income potentially exempt from state income tax. TPT Exemption Certificate - General. In 2023 the tax credits for installations will drop to 22.

Inflation-adjusted amounts for tax year 2021 are shown. For 2021 the personal federal estate tax exemption amount is 117 million it was 1158 million for 2020. The information below is provided to assist with the completion of shareholder state income tax returns.

The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022. Who qualifies for homestead exemption in Arizona. The employee can submit a Form A-4 for a minimum withholding of 13 of the amount withheld for state income tax if the annual wages are less than 15000 or 18 of the amount withheld for state income tax if the annual wages.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. F Arizonas standard deduction can be adjusted upward by an amount equal to 25 percent of the amount the taxpayer would have claimed in charitable deductions if the taxpayer had claimed itemized deductions. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. This Certificate is prescribed by the Department of Revenue pursuant to ARS. The Phoenix sales tax rate is.

The 2021 standard deduction is 12550 for single taxpayers or married filing separately. Federal Estate Tax. The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions.

The taxpayer or their spouse is blind. This means that when someone dies and the value of their estate is calculated any. Tax Year 2021 Standard Deduction and Exemptions filed in 2022 Single - 12550.

For 2021 the subtraction for benefits annuities and pensions as retired or retainer pay of the uniforms services has increased from a maximum of 3500 to 100 of the amount received during 2021. One of the states incentives for purchasing from Arizona solar programs in 2021 is their property tax exemption. This credit currently amounts to 26 of your solar systems cost after deducting the value of your state rebates.

Any person eighteen years of age or over married or single who resides within this state may hold as a homestead exempt from execution and forced sale not exceeding 250000 in value any one of the following. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from 567 million in 2020 to 4 million for individuals who die.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Recent Changes To Estate Tax Law What S New For 2019

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

How To Avoid Estate Taxes With A Trust

How Your Estate Is Taxed Or Not

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Arizona Estate Tax Everything You Need To Know Smartasset

The Mad Dash Is Over For Now Grant Morris Dodds

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is The Future Of The Estate Tax Exemption Phelps Laclair

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

Property Tax Exemption Who Is Exempt From Paying Property Taxes